Tesla doesn’t want to talk about its cars — or at least, not about the cars that have steering wheels and human drivers.

Despite weeks of reports about Tesla’s manufacturing and sales woes — price cuts, recalls, and whether a new, cheaper model would ever come to fruition — CEO Elon Musk and other Tesla executives devoted their quarterly earnings call largely to the company's autonomous driving software. Musk promised that the long-awaited program would revolutionize the auto industry (“We’re putting the actual ‘auto’ in automobile,” as he put it) and lead to the “biggest asset appreciation in history” as existing Tesla vehicles got progressively better self-driving capabilities.

In other Tesla news, car sales are falling, and a new, cheaper vehicle will not be constructed on an all-new platform and manufacturing line, which would instead by reserved for a from-the-ground-up autonomous vehicle.

Here are five big takeaways from the company's earnings and conference call.

1. Tesla’s car business is slowing down ...

The company reported that its “total automotive revenues” came in at $17.4 billion in the first quarter, down 13% from a year ago. Its overall revenues of $21.3 billion, meanwhile, were down 9% from a year ago. The earnings announcement included a number of explanations for the slowdown, which was even worse than Wall Street analysts had expected.

Among the reasons Tesla cited for the disappointing results were arson at its Berlin factory, the obstruction to Red Sea shipping due to Houthi attacks from Yemen, plus a global slowdown in electric vehicle sales “as many carmakers prioritize hybrids over EVs.” The combined effects of these unfortunate events led the company to undertake a well-publicized series of price cuts and other sweeteners for buyers, which dug further into Tesla’s bottom line. Tesla’s chief financial officer, Vaibhav Taneja, said that the company’s free cash flow was negative more than $2 billion, largely due to a “mismatch” between its manufacturing and actual sales, which led to a buildup of car inventory.

The bad news was largely expected — the company’s shares had fallen 40% so far this year leading up to the first quarter earnings, and the past few weeks have featured a steady drumbeat of bad news from the automaker, including layoffs and a major recall. The company’s profits of $1.1 billion were down by more than 50%, short of Wall Street’s expectations — and yet still, Tesla shares were up more than 10% in after-hours trading following the shareholder update and earnings call.

2. ... but that’s fine, because Tesla is really an AI company

The strange thing about Tesla is that it makes the overwhelming majority of its money from selling cars, but has become the world’s most valuable car company thanks to investors thinking that it’s more of an artificial intelligence company. It’s not uncommon for Tesla CEO Elon Musk and his executives to start talking about their Full Self-Driving technology and autonomous driving goals when the company’s existing business has hit a rough patch, and today was no exception.

Tesla’s value per share was about 33 times its earnings per share by the end of trading on Monday, comparable to how investors evaluate software companies that they expect to grow quickly and expand profitability in the future. Car companies, on the other hand, tend to have much lower valuations compared to their earnings — Ford’s multiple is 12, for instance, and GM’s is 6.

Musk addressed this gap directly on the company’s earnings call. He said that Tesla “should be thought of as an AI/robotics company,” and that “if you value Tesla as an auto company, that’s the wrong framework.” To emphasize just how much the company is pivoting around its self-driving technology, Musk said that “if somebody believes Tesla is not going to solve autonomy they should not be an investor in the company.”

One reason investors value Tesla so differently relative to its peers is that they do, actually, expect the company will make a lot of money using artificial intelligence. No doubt with that in mind, executives made sure to let everyone know that its artificial intelligence spending was immense: The company’s free cash flow may have been negative more than $2 billion, but $1 billion of that was in spending on AI infrastructure. The company also said that it had “increased AI training compute by more than 130%” in the first quarter.

“The future is not only electric, but also autonomous,” the company’s investor update said. “We believe scaled autonomy is only possible with data from millions of vehicles and an immense AI training cluster. We have, and continue to expand, both.”

Musk described the company’s FSD 12 self-driving software as “profound” and said that “it’s only a matter of time before we exceed the reliability of humans, and not much time at that.”

3. There will be some kind of new car, and it will be ahead of schedule, but that’s all Musk is willing to say

The biggest open question about Tesla is what would happen with its long-promised Model 2, a sub-$30,000 EV that would, in theory, have mass appeal. Reutersreported that the project had been cancelled and that Tesla was instead devoting its resources to another long-promised project, a self-driving ride-hailing vehicle called the “robotaxi.”

Musk tweeted that Reuters was “lying” but never directly denied the report or identified what was wrong with it, instead saying that the robotaxi would be unveiled in August. He later followed up to say that “going balls to the wall for autonomy is a blindingly obvious move. Everything else is like variations on a horse carriage.”

Before the call, Wall Street analysts were begging for a confirmation that newer, cheaper models besides a robotaxi were coming.

“If Tesla does not come out with a Model 2 the next 12 to 18 months, the second growth wave will not come,” Wedbush Securities analyst Dan Ives wrote in a note last week. “Musk needs to recommit to the Model 2 strategy ALONG with robotaxis but it CANNOT be solely replaced by autonomy.”

Anyone who expected to get their answers on today’s call, though, was likely kidding themselves.

Tesla announced today it had updated its planned vehicle line-up to “accelerate the launch of new models ahead of our previously communicated start of production in the second half of 2025,” and that “these new vehicles, including more affordable models, will utilize aspects of the next generation platform as well as aspects of our current platforms.” Musk added on the company’s earnings call that a new model would not be “contingent on any new factory or massive new production line.”

Some analysts attributed the share pricing popping after hours to this line, although it’s unclear just how new this new car would be.

Tesla’s shareholder update indicated that any new, cheaper vehicle would not necessarily be entirely new nor unlock massive new savings through an all-new production process. “This update may result in achieving less cost reduction than previously expected but enables us to prudently grow our vehicle volumes in a more capex efficient manner during uncertain times,” the update said.

Of the robotaxi, meanwhile, the company said it will “continue to pursue a revolutionary ‘unboxed’ manufacturing strategy,” indicating that just the ride-hailing vehicle would be built entirely on a new platform.

Musk also discussed how a robotaxi network could work, saying that it would be a combination of Tesla-operated robotaxis and owners putting their own cars into the ride-hailing fleet. When asked directly about its schedule for a $25,000 car, Musk quickly pivoted to discussing autonomy, saying that when Teslas are able to self-drive without supervision, it will be “the biggest asset appreciation in history,” as existing Teslas became self-driving.

When asked whether any new vehicles would “tweaks” or “new models,” Musk dodged the question, saying that they had said everything they had planned to say on the new cars.

4. Energy and charging are growing at a nice clip

One bright spot on the company’s numbers was the growth in its sales of energy systems, which are tilting more and more toward the company’s battery offerings.

Tesla said it deployed just over 4 gigawatts of energy storage in the first quarter of the year, and that its energy revenue was up 7% from a year ago. Profits from the business more than doubled.

Tesla’s energy business is growing faster than its car business, and Musk said it will continue to grow “significantly faster than the car business” going forward.

Revenues from “services and others,” which includes the company’s charging network, was up by a quarter, as more and more other electric vehicle manufacturers adopt Tesla’s charging standard.

5. Oh, and robots

Another speculative Tesla project is Optimus, which the company describes as a “general purpose, bi-pedal, humanoid robot capable of performing tasks that are unsafe, repetitive or boring.” Like many robotics projects, the most the public has seen of Optimus has been intriguing video content, but Musk said that it was doing “factory tasks in the lab” and that it would be in “limited production” in a factory doing “useful tasks” by the end of this year. External sales could begin “by the end of next year,” Musk said.

But as with any new Tesla project, these dates may be aspirational. Musk described them as “just guesses,” but also said that Optimus could “be more valuable than everything else combined.”

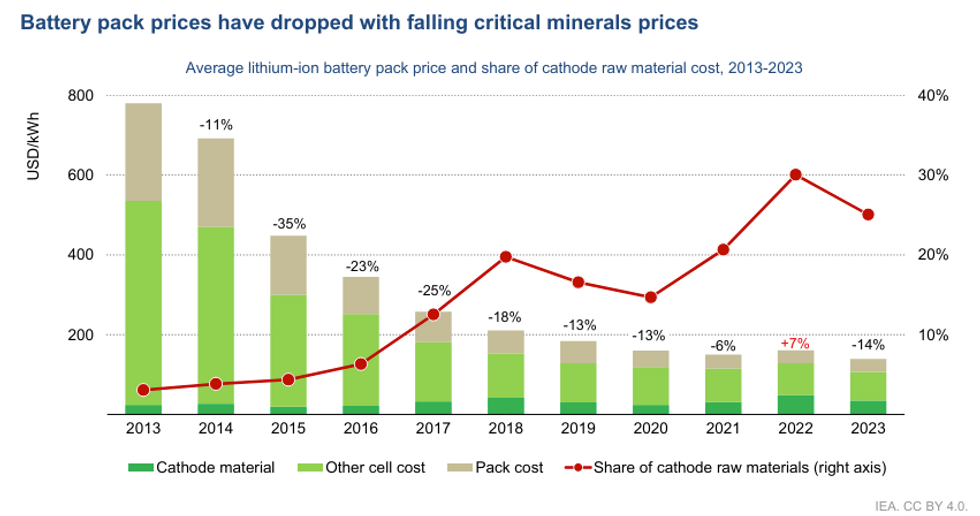

IEA

IEA